Gooood morning, money magicians! Welcome to The Funded Road, where we turn trading woes into trading WHOAS! Crafted by traders who’ve seen it all, we’re here to prove that making moolah(money) in the toughest industry is not just a pipe dream.

Here’s the magic trick lineup for today:

✍️ The TRADE

🎙️ FOMC results

And naturally, a sprinkle of giggles to keep things light…

Trade Of The Day:

Get ready for the trade that made me $500. My goal was to make more since I'm currently aiming for at least $150 per account each day, which adds up to $750 daily across five accounts. But yesterday was FOMC and I had to head out for lunch, so I squeezed in a quick trade before leaving. It wasn’t the full target, but I was happy to lock in $100 per account and walk away with $500 total.

Trade Numbers

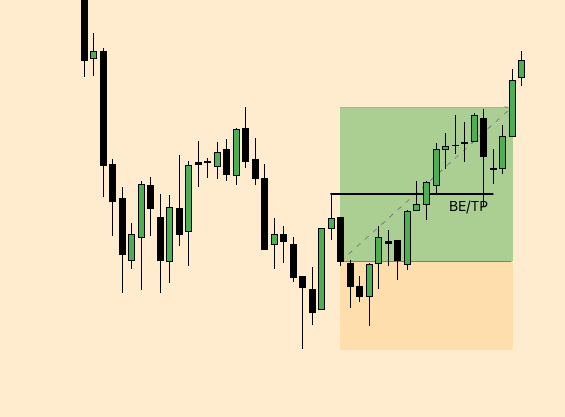

ENTRY 1 - Long Nasdaq at $19,924 (1min IFVG + 1min FVG)

Take Profit: $19,950.75 (Small Liquidity)

Stop Loss: $19,908.75 (Last swing low)

Why did I enter this trade?

When I got to the charts, I noticed we had a big overnight move that left behind a 15-minute and a 5-minute IFVG. I checked the London high and low, both had already been taken out, so I had no clear directional bias from that. My only bias came from the following setup:

We moved higher, then consolidated, dropped lower taking out liquidity, and by 8:30 AM (my trading start time), I saw we were sitting right at the midpoint of the 15-minute IFVG from the previous day and had just tapped into a 5-minute IFVG. That gave me confidence we’d at least see a small bounce, even if we were going to continue lower.

And that’s exactly what happened. We reversed, formed a 1-minute FVG and IFVG, pushed up to close above the last 5-minute swing high, then started dropping again. I caught that quick bounce and locked in $500.

Trade Checklist:

Identified overnight move and marked 15-min and 5-min IFVGs

Confirmed London high and low were both taken out — no directional bias from them

Noted liquidity sweep to the downside before 8:30 AM (my allowed entry time)

Entered at 5-min IFVG and midpoint of 15-min IFVG for a quick bounce play

Took profit as price pushed above 5-min swing high and started reversing again

FOMC RESULTS

The FOMC held interest rates steady at 4.50% in a unanimous decision, marking the third straight meeting with no changes. Their statement highlighted growing uncertainty in the economic outlook, especially due to a sharp rise in tariffs, which are expected to push both inflation and unemployment higher. With tensions rising between the Fed’s goals of price stability and full employment, the Committee appears to be in a wait-and-see mode. Chair Powell emphasized there's no urgency to adjust rates, especially while the economy remains stable. Markets now expect rate cuts later in the year, though likely less aggressive than previously forecasted.

And thats it for today! Let us know bellow how you liked the pilot of our new newsletter, see you tomorrow!