Gooood morning, money magicians! Welcome to The Funded Road, where we turn trading woes into trading WHOAS! Crafted by traders who’ve seen it all, we’re here to prove that making moolah(money) in the toughest industry is not just a pipe dream.

Here’s the magic trick lineup for today:

✍️ Trade of the day (And the dream setup we missed…)

🎙️Breakdown

And naturally, a sprinkle of giggles to keep things light…

Trade Of The Day:

Alright, traders, confession time. I missed the trade—the one that was calling my name, lined up perfectly, practically gift-wrapped… and I just watched it sail by. You know the pain. But hey, the market's always got something else cooking, right?

The trade that missed me:

Entry - SHORT Nasdaq @ $21,315.5

Take Profit: $21,122 (Previous Day Low)

Stop Loss: $21,341 (High of Day)

Almost 200 handles missed, not gonna lie, I was a little bit tilted while watching price not filling me, and running slowly but surelly away into the target

Let’s look at the trade I did take

So, after some quick mental recovery (and maybe a few choice words), I found myself in another setup. Was it as pretty as the first one? Not exactly. But money’s money, and sometimes you’ve got to work with what the market hands you. Let’s dive into how this one played out and how I still walked away with a win.

Bunt for a base hit:

Entry - LONG Nasdaq @ $21,186

Take Profit: $21,206 (Internal Liqudity)

Stop Loss: $21,161(25 handles, and IFVG low)

It ain’t much, but it’s an honest work

Breakdown Of The Dream Grandslam

Let’s first look at the grandslam, that could’ve been…

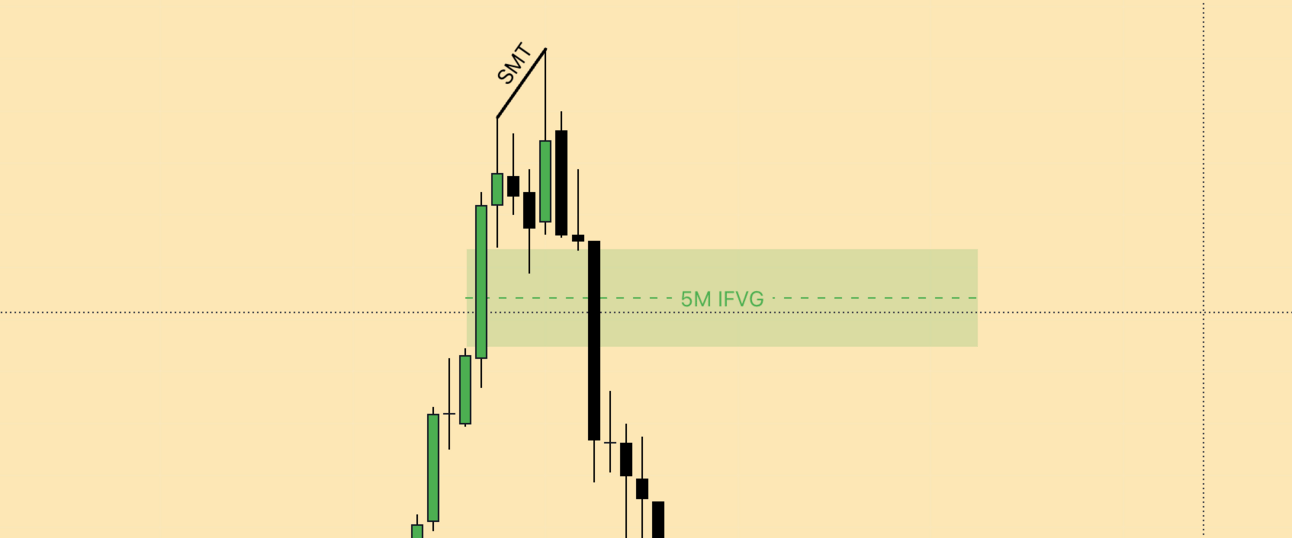

I wanted to enter this trade for 3 simple concepts

Taking out the manipulation level of Stat-map

SMT with ES

5m IFVG

For those of you that don’t know what these terms mean, check out our youtube course, that will explain all of this in detail.

Sadly as you can see on the picture bellow, we have never re-entered the 5 minute IFVG, so the trade never happened.

The 20 Handle Trade

And here’s where sticking to your model really pays off!

So, why did I enter?

The manipulation level on the Stat-map had been cleared.

A juicy 5-minute IFVG showed up.

And, of course, we had some tasty close liquidity waiting.

This setup actually looked a lot like the first trade I missed (still hurts a bit, by the way). Once I saw price reacting to that Stat-map manipulation level, I was on high alert for either a market structure shift or inversion. Then, it was all about spotting the liquidity targets we could aim for.

Now, I wasn’t planning on holding this one forever. My higher timeframe analysis was pointing down, so I was just looking for a quick win—a mood booster after missing that big trade earlier. And hey, sometimes a quick in-and-out is just what you need to get back on track!

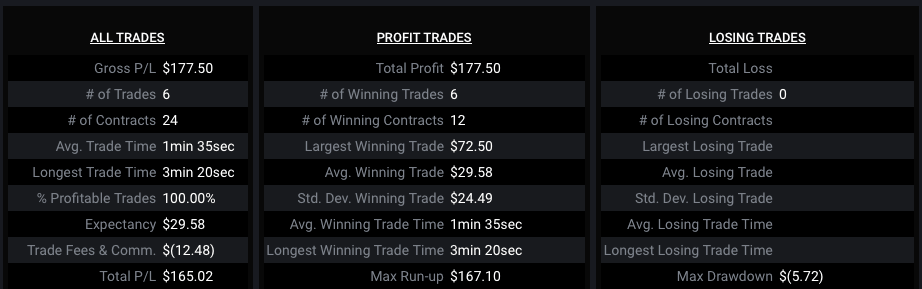

And finally the proof, today I’ve made $165 on 5 accounts

And thats it for today! Let us know bellow how you liked the pilot of our new newsletter, see you tomorrow!